- 25 February 2024 (122 messages)

-

-

i imagine a sort of multisend tx where you can send assets to multiple outputs created with that tx, then you can spend them into new outputs or into an address

i imagine a sort of multisend tx where you can send assets to multiple outputs created with that tx, then you can spend them into new outputs or into an address -

you move assets in and out of UTXOs

-

Per Derp's CIP:

>Since Counterparty assets used in this way aren't permanently tied a sat, but optionally bound and unbound, when it comes time to move an asset out of a UTXO and back into a users wallet, the updated send function will be used. It will take the asset containing UTXO and user payments as input. Outputs will include the function to move the asset from the UTXO to the users wallet and the users change output. -

-

-

it's a major architectural change... like dispensers.

-

except awesome.

-

but back to the immediate issue at hand: is the dev/business/dapp/whatever community open to possibly reverting close delays?

-

i think so

i think so -

I don’t think you’ll face any resistance. I bet most people don’t even realize it exists

I don’t think you’ll face any resistance. I bet most people don’t even realize it exists -

I would revert a couple of things 🤓

I would revert a couple of things 🤓 -

-

def makes sense to include any other pressing issues

def makes sense to include any other pressing issues -

it's not user facing and doesn't solve the problem, so I think it's quite compelling.

-

BTW we got to checkpoint @ block 825k

-

very, very good news.

-

almost there!

almost there! -

yes! I am honestly astounded, 6k blocks to go but if nothing changes no one will have lost money because of consensus breaks

-

and will not need to rewrite history.

-

i had faith

i had faith -

I honestly didn't

-

but still super happy

-

don't want to jump the gun, ofc...

-

whats 7000 blocks between friends

whats 7000 blocks between friends -

if it were between friends there'd be no need for a blockchain lol

-

If anyone's interested.... https://github.com/CounterpartyXCP/counterparty-lib/pull/1444/files#diff-47adff1c5b07e2a5af9594b85b9b3ec6811034b849d26499d3f57efcfe2263c7R323[WIP] Pass checkpoint 800000 by ouziel-slama · Pull Request #1444 · CounterpartyXCP/counterparty-lib

Counterparty Protocol Reference Implementation. Contribute to CounterpartyXCP/counterparty-lib development by creating an account on GitHub.

-

BAD_ADDRESSES is a great variable name

BAD_ADDRESSES is a great variable name -

-

the culprit: https://github.com/CounterpartyXCP/counterparty-lib/blob/master/counterpartylib/lib/blocks.py#L800counterparty-lib/counterpartylib/lib/blocks.py at master · CounterpartyXCP/counterparty-lib

Counterparty Protocol Reference Implementation. Contribute to CounterpartyXCP/counterparty-lib development by creating an account on GitHub.

-

-

yup

-

instead of throwing an error for an unsupported address type (p2wsh) the scriptpubkey was just truncated so it was a supported address type (p2wpkh)

-

what's neat is that when we release the fix the effect will be the opposite of what you'd expect from a consensus break: people will gain access to funds that had been effectively lost.

-

Yes lol

Yes lol -

-

-

i think mathematically it'd be impossible for any of these addresses to be valid.

-

sorry, they're *valid*, but unspendable.

-

can Mr Unspendable himself, @teysol, confirm pls.

-

sheesh i didn't even think about this; I assumed the way the seller rugged the buyer was by filling the order with a higher fee, but of course you're right, you can rug the buyer just by closing the dispenser. good grief.

-

that's correct

-

despite the dev team working on pbst... is it possible this protocol issue with 'minimum order amount' for BTCpay could be looked at? Alot of the users over many years have wanted to use this functionality (understanding the Auto BTC-pay and leaving FW open to do so).... but when they want to test it with low btc amounts, the protocol does not match orders

despite the dev team working on pbst... is it possible this protocol issue with 'minimum order amount' for BTCpay could be looked at? Alot of the users over many years have wanted to use this functionality (understanding the Auto BTC-pay and leaving FW open to do so).... but when they want to test it with low btc amounts, the protocol does not match orders

https://github.com/CounterpartyXCP/counterparty-lib/issues/1278Bug for small BTC size order with BTCPAY · Issue #1278 · CounterpartyXCP/counterparty-libLooking to see if this bug mentioned here CounterpartyXCP/cips#96 (comment) can get looked at and fixed to help new users wanting to use small amounts of BTC to be able to succesfully use the BTC/T...

-

I can't say what order things will be done in. Quite limited resources and there are still lots of problems, but if you ping Adam on GitHub he can assign a priority to it.

I don't know what the upside of keeping BTCPay is if we have atomic swaps. Would be curious to hear others' thoughts. -

I don't like being dramatic but you've got to understand that the code is basically in a pre-production ready state and hosts $1B of assets

-

I think users will still want a way to trade assets that aren’t bound to utxos.

-

its moreso an issue that has spanned multiple years without a fix... and in the meantime before atomic swap and psbt goes live users would love to use it and "have it work"... especially when its a trustless way to transact btc (and a very historical one as well that predates dispensers)

its moreso an issue that has spanned multiple years without a fix... and in the meantime before atomic swap and psbt goes live users would love to use it and "have it work"... especially when its a trustless way to transact btc (and a very historical one as well that predates dispensers) -

this is independent of BTCPay

-

dex will still exist

-

-

- 26 February 2024 (783 messages)

-

In order to reach MVP we've got to fix: consensus bugs (which exist!), performance, and deployment. Issues with the latter two are why the first went undetected for literally years...

-

-

-

I hear you, but the potholes need to take a backseat to making sure that the bridge doesn't collapse in on itself while people are driving. User-facing problems are bad of course, but if the consensus system can't maintain consensus then everything else is moot.

-

-

🤷♀️can't please everyone

-

we haven't come across any unfixable problems (except features of dispensers masquerading as bugs). The speed at which they're fixed though is a function of time and money.

-

@herpenstein this is an overly-subtle point. The question isn't whether we have a way to trade Counterparty assets for each other without binding them to UTXOs; that's what the dex is for and it's not going anywhere. The question rather is whether we should maintain a way to trade Counterparty assets for BTC without attaching them to UTXOs given the problems with BTCPay.

-

And I can imagine having both options causing serious UX headaches.

-

the dex is suitable for asset to asset trading and has worked wonderfully for years, psbts are an asset to Bitcoin solution and are superior to both btcpay and dispensers

the dex is suitable for asset to asset trading and has worked wonderfully for years, psbts are an asset to Bitcoin solution and are superior to both btcpay and dispensers -

They solve the shortcomings of both

They solve the shortcomings of both -

So would replace both then?

-

IMO yes

IMO yes -

itshappening.gif

-

both features have been cause for various headaches

-

Yes because they were trying to solve the difficult problem of trading btc for assets

Yes because they were trying to solve the difficult problem of trading btc for assets -

but you guys figured it out. Derp Herpenstein and Hodlen Coinfeld

-

Utxo binding plus psbts is the elegant solution

Utxo binding plus psbts is the elegant solution -

Well, ordinals figured it out

Well, ordinals figured it out -

To be fair

To be fair -

i just like saying silly names earnestly

-

Its a bitcoin solution which means all the second layers can utilize it

Its a bitcoin solution which means all the second layers can utilize it -

I’m looking forward to the merging of the marketplaces in the ecosystem

-

samesies

-

It’s such a stark contrast to eth too, I love it

It’s such a stark contrast to eth too, I love it -

increasing liquidity helps _everyone_

-

really looking fwd to it. New dev, who will be working on it in due time, made his first PRs this weekend btw

-

AFAICT once you enable UTXO binding atomic swaps are strictly better than BTCPay. If you couple that with a standardized off-chain way of doing dispensers I think you've got a pretty good setup.

-

It’s not trustless tho. You need to have your txn confirm within 20 blocks or you can get rugged in a very similar fashion to a dispenser (except maybe safer because you do have 20 blocks). Safer… but not trustless.

It’s not trustless tho. You need to have your txn confirm within 20 blocks or you can get rugged in a very similar fashion to a dispenser (except maybe safer because you do have 20 blocks). Safer… but not trustless. -

No one is going to miss BTCPay because literally no one uses it because of how bad the UX is

No one is going to miss BTCPay because literally no one uses it because of how bad the UX is -

Whatchu mean if order doesn't match it can simply be cancelled like dex can

Whatchu mean if order doesn't match it can simply be cancelled like dex can -

Though this is true... Only one wallet supports it and has a big bug in it

Though this is true... Only one wallet supports it and has a big bug in it -

Bitcoin is unique on the dex. At some point the bitcoin txn is broadcast. You have 20 blocks for it to confirm to get the asset. If it takes 21 blocks you’ve sent the bitcoin but won’t get the asset

Bitcoin is unique on the dex. At some point the bitcoin txn is broadcast. You have 20 blocks for it to confirm to get the asset. If it takes 21 blocks you’ve sent the bitcoin but won’t get the asset -

Which just leaves it as an open order on the DEX UI in FW... Which means cancelling the order would return the BTC .. though haven't tested that specifically.. was just my understanding of how that feature worked

Which just leaves it as an open order on the DEX UI in FW... Which means cancelling the order would return the BTC .. though haven't tested that specifically.. was just my understanding of how that feature worked -

Bitcoin isn’t escrowed by the protocol. Bitcoin txn gets broadcast. Now you could try double-spending it back, but you can’t “cancel” it because it was broadcast. You sent bitcoin to another address at the base layer. The base layer has no awareness of counterparty

Bitcoin isn’t escrowed by the protocol. Bitcoin txn gets broadcast. Now you could try double-spending it back, but you can’t “cancel” it because it was broadcast. You sent bitcoin to another address at the base layer. The base layer has no awareness of counterparty -

Gotchya didn't know that

Gotchya didn't know that -

this makes sense. i know it's crazy to hear in 2024 but in 2013 people didn't worry about full blocks

-

Mike, I assume Stamps relies quite heavily on dispensers, is that right?

-

would moving them off-chain be very disruptive if you had atomic swaps in addtn?

as an end-user I believe the only thing you really lose by taking dispensers off chain is the abilty to have the dispenser be both non-custodial and not require you to keep your wallet open. -

(imo this is a bad reason to put logic on-chain. doesn't solve a trust issue, but just sort of outsources a business to the blockchain)

-

Yes, dispensers are the number 1 trading mechanism for Stamps - though tbf, src20 now makes up about 90% of stamps traffic and those don't use dispensers at all

Yes, dispensers are the number 1 trading mechanism for Stamps - though tbf, src20 now makes up about 90% of stamps traffic and those don't use dispensers at all -

how do you trade them?

-

-

Removing dispensers? That would be very disruptive to the broader CP community.

Removing dispensers? That would be very disruptive to the broader CP community. -

You're gonna laugh but its in the same insane way that BRC-20 are traded. You mint a "transfer" which is essentially its own stamp

You're gonna laugh but its in the same insane way that BRC-20 are traded. You mint a "transfer" which is essentially its own stamp -

-

Trusted PSBT through marketplaces

Trusted PSBT through marketplaces -

🤷♀️this industry didn't develop as I thought it would at all

-

i'm not advocating it (though I think it's the right thing to do). atm i am trying to understand the community's needs. again, you wouldn't replace dispensers with nothing, but an off-chain solution. the only thing you'd lose AFAIK is non-custodial dispensers that don't require users to keep their wallet open. OTOH you get PSBTs

-

dispensers already were an offchain business at one point. OGs will recall Vennd[.]io

-

Then swapbots after that

Then swapbots after that -

would the new atomic swap method work with "supply"... or would the tokens need to be single supply?

would the new atomic swap method work with "supply"... or would the tokens need to be single supply? -

I think there's some inside baseball I'm missing. @hodlencoinfield ?

-

idk what 'supply' is as a term of art.

-

Most people cannot maintain the server infrastructure to run their own offchain solution like vennd or swapbots

Most people cannot maintain the server infrastructure to run their own offchain solution like vennd or swapbots -

Right, I get that. I think its more a cultural thing at this point. Its very ingrained into the culture.

Right, I get that. I think its more a cultural thing at this point. Its very ingrained into the culture. -

yep, that's exactly the tradeoff

-

I think if anything you need to ween people off of them by showing a better solution

I think if anything you need to ween people off of them by showing a better solution -

I am going to speak out of turn and get berated privately I am sure but if I am not mistaken PSBTs and dispensers may be in conflict with each other, architecturally.

-

With a dispenser you can set one up with 100 or even 1000 supply and just let it run. With an atomic swap would you need to set-up 100 of them?

With a dispenser you can set one up with 100 or even 1000 supply and just let it run. With an atomic swap would you need to set-up 100 of them? -

Many artists use dispensers as their sales channel because for a one time cost of a Tx fee I can sell 100 editions

Many artists use dispensers as their sales channel because for a one time cost of a Tx fee I can sell 100 editions -

This is where dispensers still have an advantage

This is where dispensers still have an advantage -

right

right -

That's very much the culture. Selling editions with a single txn

That's very much the culture. Selling editions with a single txn -

If they’re artist deployed then there’s no trust issue

If they’re artist deployed then there’s no trust issue -

could you do a decentralized minting thing as an ersatz for that

-

That’s not a bad idea

That’s not a bad idea -

It is different tho and only works for new assets

It is different tho and only works for new assets -

I don't think there's going to be a perfect replacement

-

dispensers are unique precisely because of the tradeoffs they make

-

if you replace them with a solution that doesn't make those same tradeoffs you won't get the same perceived benefits.

-

There may be something clever you can do to keep it non-custodial, off-chain and solve the availability problem

-

You might be able to create a central order book but have users self-custody keys. Sellers sign txs, and a TTP broadcasts them when there's a matching buy.

-

idk just thinking outloud. might not make any sense.

-

Yea, I think there are def clever things with utxo binding we haven’t considered, functions in addition to “send to address”

Yea, I think there are def clever things with utxo binding we haven’t considered, functions in addition to “send to address” -

the high-level requirements are: off-chain, non-custodial, and available.

-

we need Hodlen Coinfeld and Derp Herpenstein to have another revelation.

-

Yup that's basically what the Stamp marketplaces are doing "Trusted PSBT".

Yup that's basically what the Stamp marketplaces are doing "Trusted PSBT". -

IMO this is a very reasonable middleground.

-

no one wants to custody keys. custodying signed txs OTOH...

-

TBH if there's no/minimal financial regulation around this it would be a _phenomenal_ business.

-

@mikeinspace who's the tx custodian in Stamps land?

-

The 2 marketplaces doing this are:

The 2 marketplaces doing this are:

openstamp.io

stampscan.xyz -

and those companies specificaly provide the service of custodying signed PSBTs and creating an order book?

-

Yes, and they take fee in the process. I think its free to list (and cancel) but if it sells, the signed txn gives them a cut

Yes, and they take fee in the process. I think its free to list (and cancel) but if it sells, the signed txn gives them a cut -

yeah, that's a phenomenal business model.

-

good for them.

-

Okay, I think I've done enough irresponsible brainstorming for one night lol. But it sounds like there are good options and middlegrounds.

-

actually it wouldn't be the signed txn giving them a cut it would be the buyer.

actually it wouldn't be the signed txn giving them a cut it would be the buyer. -

magiceden was sending all their fees direct to their coinbase wallet so they didnt even have to pay to consolidate 😆

magiceden was sending all their fees direct to their coinbase wallet so they didnt even have to pay to consolidate 😆 -

yeah that was brilliant. They stuck coinbase with the consolidation cost.

yeah that was brilliant. They stuck coinbase with the consolidation cost. -

so good

so good -

Apparently, coinbase routinely loses a shit ton of money sometimes >100% value in the process

Apparently, coinbase routinely loses a shit ton of money sometimes >100% value in the process -

yeah i saw something like 35 BTC extra over spend in fees

yeah i saw something like 35 BTC extra over spend in fees -

for just the magiceden acct

for just the magiceden acct -

I should do this with my dispensers... I just did a consolidation and it cost me about $30 due to all the inputs

I should do this with my dispensers... I just did a consolidation and it cost me about $30 due to all the inputs -

hahaha

hahaha -

1.8 million USD isn't worth the effort to even fix the bug lol

1.8 million USD isn't worth the effort to even fix the bug lol -

they’re printing money over there, thats barely a rounding error

they’re printing money over there, thats barely a rounding error -

a concern I have with an off-chain replacement involving a third party is that the latter of course would need to be paid for their services, whereas dispensers, as Counterparty users know them, are free. IMO that was a mistake: dispensers have a serious externalized cost (as is evidenced by how long block parsing takes) and should have had some sort of XCP fee associated with them.

In any event, is paying for a dispensing service something the community could adjust to? -

A new gas mechanism need to make infrastructure dev work and business sustainable on protocol level ...all event as long as cost cp resources need to pay gas

-

Gas collected partially can be used to support dev ...fully paid job makes work more fast and motivated

-

you can't do that without centralizing the project in a way that I at least would not be in support of.

-

With the current tx structure, a user would have to trust their counterparty to perform any trade in 1 tx.

As things are now, a PSBT of an asset send in exchange for btc has the same downside as buying from a dispenser. If artists/buyers accept those risks, this structure can do something somewhat similar. -

The artist would need x utxos and to sign x psbts

-

And if the artist doesn’t otherwise move the assets, anyone who executed a utxo would get the asset

-

Definitely more cumbersome, unless the ui allowed for bulk signing with a single click

-

And the expense of splitting utxos

-

Regarding the gas fee, definitely appreciate the need for it. I also can't proclaim what would be the best "engineering" solution, but an alternative proposal has been discussed a bit that might satisfy the requirements (addressing externalized costs) while keeping user friction low.

Regarding the gas fee, definitely appreciate the need for it. I also can't proclaim what would be the best "engineering" solution, but an alternative proposal has been discussed a bit that might satisfy the requirements (addressing externalized costs) while keeping user friction low.

Essentially, user pays exclusively in Bitcoin and some of that Bitcoin is used to purchase xcp from the market and burn it (ideally all within a single txn). In this way, the gas situation is addressed while the user doesn't need to go through the friction of aquiring xcp.

Candidly, such an approach does "help" stamps as its more aligned with the project's "ethos" but I think it also helps Counterparty by ensuring a low-friction environment (user growth) as well as create a constant demand for xcp. -

if its in xcp and is able to deploy multiple dispensers on multiple addresses (even if more in xcp) it might be viable... but with recent prices i might do an educated guess of 0.05 xcp as a number to start with... im not sure how the community would take that tho.... being so used to dispensers and dex using just a btc tx fee

if its in xcp and is able to deploy multiple dispensers on multiple addresses (even if more in xcp) it might be viable... but with recent prices i might do an educated guess of 0.05 xcp as a number to start with... im not sure how the community would take that tho.... being so used to dispensers and dex using just a btc tx fee -

something 'similar' in theory was discussed in the github somewhat recently here: https://github.com/CounterpartyXCP/cips/discussions/92#discussioncomment-8561841Asset Issuances paying only BTC · CounterpartyXCP/cips · Discussion #92

something 'similar' in theory was discussed in the github somewhat recently here: https://github.com/CounterpartyXCP/cips/discussions/92#discussioncomment-8561841Asset Issuances paying only BTC · CounterpartyXCP/cips · Discussion #92Currently in order to issue a Named asset or Subasset, an XCP anti-spam fee is required. One of the primary complaints I have heard over the years is that "Counterparty requires a shitcoin (XC...

-

It's 2024: if we don't have dynamic fees that scale with demand then we're hosed. I think as a rule no more hard-coded fees going fwd.

-

yep, Adam and I actually have built exactly this kind of tx chaining before. That was for a different kind of blockchain but pretty sure we can do it again.

-

@herpenstein good thoughts! thank you.

-

Delayed Dispenser Closing · CounterpartyXCP/cips · Discussion #120

Delayed Dispenser Closing · CounterpartyXCP/cips · Discussion #120It was suggested on Telegram that closing of dispensers should be delayed by five blocks. This to prevent an attack vector ("rugspenser") where seller detects incoming dispense and immedi...

-

-

-

With psbt do the seller and buyer need to be online at the same time?

With psbt do the seller and buyer need to be online at the same time? -

-

-

dbcache= setting in bitcoin.conf can help during initial sync

dbcache= setting in bitcoin.conf can help during initial sync

Add as much dbcache as your setup/ram allows whilst doing the initial sync n then drop it back to normal once your at the chain tip -

832062 getting closer for those following along...

832062 getting closer for those following along... -

Joined.

-

the PR to pass checkpoint @ block 825k was merged: https://github.com/CounterpartyXCP/counterparty-lib/pull/1444[WIP] Pass checkpoint 800000 by ouziel-slama · Pull Request #1444 · CounterpartyXCP/counterparty-lib

Counterparty Protocol Reference Implementation. Contribute to CounterpartyXCP/counterparty-lib development by creating an account on GitHub.

-

This seems kind of slow for initial block download on AWS.About the same that I was getting with Starlink, while I was definitely being metered.

-

ya perhaps it is the instance as it is not crazy big

ya perhaps it is the instance as it is not crazy big -

it is a t2.large

it is a t2.large -

but based on monitoring does not look over utilized

but based on monitoring does not look over utilized -

anyway, once bitcoind is caught up should be unaffected by network stuff.

-

it is up todate now, so on to next step

it is up todate now, so on to next step -

@teysol just said this: "fyi I just did a kickstart on a GCP 4-core machine on mainnet and it took <24 hours to get to block 800k". @XJA77 what were the specs of the machine that catch-up took two weeks on?

-

Ryzen7 16gb

Ryzen7 16gb -

-

looking like a > 10x speedup on mainnet 😊

-

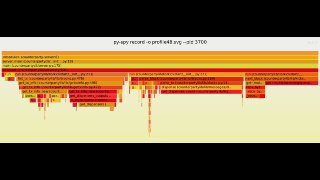

For anyone interested to see the externalized cost of dispensers, here's profiling done after extensive optimization.

-

-

Right :/. Is there a way to quantify the corresponding performance hit to that limitation?

-

or is it basically just taking list_tx() down to zero

-

-

-

list_tx() and dispense() together account for 60% of block parsing time lol

-

Some people still trust.

Some people still trust. -

24 hours is on par with ord

24 hours is on par with ord -

-

even longer for ord if you enable sat-index

even longer for ord if you enable sat-index -

-

does ord parsing also have to be done serially wrt bitcoind catch-up?

-

yes, you wait til bitcoind is caught up before running ord

yes, you wait til bitcoind is caught up before running ord -

wow that's great for us

-

nice find @hodlencoinfield

-

would know better running both on the same machine

would know better running both on the same machine -

better comparison anyway

better comparison anyway -

@teysol when we kill addrindexrs we'll be bringing the necessary indexing in-house, yeah?

-

👋

-

how do you imagine that change will affect performance?

-

-

-

-

right.

-

-

aren't there privacy implications to this?

-

(I agree the security concerns are not real)

-

-

-

-

obviously eliminating addrindexrs from the stack would be great since then counterparty-lib would only need bitcoind

obviously eliminating addrindexrs from the stack would be great since then counterparty-lib would only need bitcoind -

-

-

-

maybe just incorporate some of its functionality directly into counterparty-lib

maybe just incorporate some of its functionality directly into counterparty-lib -

targeting v11.0?

-

-

the biggest benefit is for block explorers and wallets

the biggest benefit is for block explorers and wallets -

being able to query txs by address is a necessity for both of those

being able to query txs by address is a necessity for both of those -

I think an issue is that if I'm not mistaken with 9.61addrindexrs became a consensus-critical dependency.

-

i'm getting the following error as I used 8333 and not 8332 I think

i'm getting the following error as I used 8333 and not 8332 I think -

not sure how to reset and if I need to rebuild

not sure how to reset and if I need to rebuild -

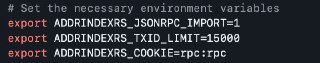

export ADDRINDEXRS_INDEXER_RPC_ADDR=0.0.0.0:8432

export ADDRINDEXRS_INDEXER_RPC_ADDR=0.0.0.0:8432

export ADDRINDEXRS_DAEMON_RPC_ADDR=localhost:8332 -

not sure when it started tbh, im not sure how dispensers would work without utilizing that to some degree

not sure when it started tbh, im not sure how dispensers would work without utilizing that to some degree -

I think I need these to be 8332, sorry just the 2nd one

I think I need these to be 8332, sorry just the 2nd one -

i was under the impression it was a necessity prior to that which is why we always used the btcdrak patched core prior

i was under the impression it was a necessity prior to that which is why we always used the btcdrak patched core prior -

I believe drak's patch was for wallet functionality, not consenus-y stuff

-

but seems it was just for counterblock and counterwallet

but seems it was just for counterblock and counterwallet -

@robotlovecoffee what is your error?

-

WARN - failed to connect daemon at 127.0.0.1:8332: Connection refused (os error 111)

WARN - failed to connect daemon at 127.0.0.1:8332: Connection refused (os error 111) -

running cargo run --release -- -vvv

running cargo run --release -- -vvv -

do you have the right auth credentials?

-

wallet functionality IS still important but yeah that was a misunderstanding i personnally had regarding why it was necessary

wallet functionality IS still important but yeah that was a misunderstanding i personnally had regarding why it was necessary -

no argument here.

-

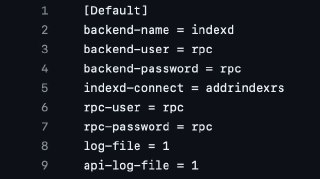

so the default bitcoind mainnet port is 8332; ADDRINDEXRS_DAEMON_RPC_ADDR tells addrindexrs what port to use to talk to bitcoind

-

my .config is

my .config is -

rpcallowip=127.0.0.1

rpcallowip=127.0.0.1

rpcuser=rpc

rpcpassword=rpc

server=1

txindex=1

rpcport=8333

addresstype=legacy

prune=0

mempoolfullrbf=1

listen=1

dbcache=4000 -

-

-

-

-

so he should pull develop for both addrindexrs and counterparty-lib and counterparty-cli, yeh?

-

-

ah awesome!

-

-

-

sorry for the lone windows dev here... I chaneg btc .config to remove most but not all right? I still need txindex

sorry for the lone windows dev here... I chaneg btc .config to remove most but not all right? I still need txindex -

for btc config just remove the rpcport I think. everything else is fine

-

restart shell is reboot instance?

restart shell is reboot instance? -

nah

-

just the BTC stop start

just the BTC stop start -

just open a new terminal, you didn't globally set those env vars

-

to pull new vars

to pull new vars -

-

so at the moment I ssh into my aws start a screen for btc node and run it, then I was trying to create another screen to get the addr working

so at the moment I ssh into my aws start a screen for btc node and run it, then I was trying to create another screen to get the addr working -

-

I assume I stop btc node to pull new .config

I assume I stop btc node to pull new .config -

yep i think that's right

-

-

-

TXID_LIMIT 😭

-

does excuting this overwrite existing vars

does excuting this overwrite existing vars -

yes

-

ok

ok -

consensus-critical environment variable...

-

INFO - NetworkInfo { version: 260000, subversion: "/Satoshi:26.0.0/" }

INFO - NetworkInfo { version: 260000, subversion: "/Satoshi:26.0.0/" }

INFO - BlockchainInfo { chain: "main", blocks: 832136, headers: 832136, bestblockhash: "000000000000000000015106f35ac24de60a371a2382cbf5b192a852f1837993", pruned: false, initialblockdownload: false }

DEBUG - opening DB at "./db/mainnet" -

all good!

-

got something diff so think that might have worked

got something diff so think that might have worked -

yep, give it a sec

-

addrindexrs logging is inconsistent and bad so don't read too much into it

-

this is the message that lets you know it's working. (NB: it'll write to directory mainnet if you're on testnet, so if you want to run a testnet instance probably should specify a new addrindexrs db-dir)

-

@robotlovecoffee just fyi addrindexrs does some compaction thing that gets its db down to ~132GB, but before that it's > 300GB. I think you should provision for 500GB

-

i did a 1.5gb disk

i did a 1.5gb disk -

TB?

-

1.5tb should be plenty.

-

fck yes, T

fck yes, T -

If you know what commands would produce what you want I can expertly paste them.

If you know what commands would produce what you want I can expertly paste them. -

lol all good! we got what we need. thank you, though!

-

@robotlovecoffee it's hard to know when addrindexrs is done but I think you should see a message that looks _something_ like this:

DEBUG - applying 0 new headers from height 832149

INFO - Indexer RPC server running on 127.0.0.1:8432 (protocol 1.4)

would be great if someone else could confirm. -

how long should I want to check?

how long should I want to check? -

tomorrow?

tomorrow? -

Ord starts indexing in parallel with Bitcoin, not after

Ord starts indexing in parallel with Bitcoin, not after -

that must be new

that must be new -

i have to run ord index update any time i want to catch up to the current block

i have to run ord index update any time i want to catch up to the current block -

About the discussion of dispensers, I think it will be hard to replace with a better UX. So I think it should be about optimizing what currently exists:

About the discussion of dispensers, I think it will be hard to replace with a better UX. So I think it should be about optimizing what currently exists:

1. Only check the first output (multi outputs was added in the last release so we can include it as part of “reverting recent bad updates”)

2. No more always open for free. Adding an XCP deposit for keeping the dispenser open. This XCP is deducted per block by X amount until depleted. Or if the dispenser is consumed, the XCP left is returned. -

Maybe, is my experience with the latest version I’m running

Maybe, is my experience with the latest version I’m running -

So tentatively it seems that there may be some conflict between atomic swaps and dispensers. I can't opine on the details, will leave that to @teysol.

RE: the optimizations you mentioned:

1. doesn't work unfortunately, because of the design of dispensers. You can't break after the first is_dispensible() returns True, since dispensing addresses can call other dispensers.

2. totally in favor of adding fees along the lines you described: I'd make it similar to a margin position, where the fee is in proportion to the value of the dispenser (way to determine that is itself TBD) and how long it's open. I think the performance impact of a dispenser also grows in the number of dispensers that address has opened, so I'd add a fee there, too. And yeah, I'd make it extremely expensive to close the dispenser. In any event, the fee system would mean that 'set-it-and-forget-it' dispensers are no longer a thing.

(1) and (2) would massively degrade the UX of course, and would therefore make the argument for keeping the logic on-chain less compelling. But even if the UX were the same I am personally strongly opposed to putting applications on-chain if the only upside is UX (as it is with dispensers). I try not to be opinionated on how the blockchain is used, but dispensers make Counterparty worse for everybody else both directly (by wrecking the performance) and indirectly (by making the codebase much less maintainable).

The real way to get the desired UX is for somebody to run a business doing off-chain what dispensers do on-chain. In the absence of that, we can do our best to approximate the UX of dispensers in a wallet. Will it be perfect? No. Is the tradeoff worth it? IMO absolutely. -

Unfortunately the users, the sellers and buyers, don’t see any of the protocol performance issues. And buyers won’t see any UX difference, so I wouldn’t describe it as a massive degradation. And really, the buyers are the most important users to please in UX.

Unfortunately the users, the sellers and buyers, don’t see any of the protocol performance issues. And buyers won’t see any UX difference, so I wouldn’t describe it as a massive degradation. And really, the buyers are the most important users to please in UX.

For them, dispensers are great. And it is shown by their popularity.

The only “negative” is the front running, but that is just part of it all as it also affects the most fundamental protocol action of issuing assets.

And I’m in favor of adding new ways to sell assets offchain, maybe with better “deals” (clearly for sellers as they won’t have to burn XCP to keep them open) than dispensers. But removing dispenser’s buyer UX as it exist today is not practically feasable imo. -

if there is a choice between atomic swaps and dispensers, which do we choose?

-

-

I am not sure I follow. So by that logic, it's okay to get rid of dispensers if we have atomic swaps, yes?

-

The buyers will see one important UX difference: fewer dispensers because punitive fees (and they don't make sense unless they're punitive) will price sellers out.

-

does anyone know how this is possible?

-

-

Haven’t studied those implementation details

Haven’t studied those implementation details -

I mean atomic swaps as detailed in Derp's CIP: https://github.com/CounterpartyXCP/cips/discussions/134PSBT Support via attaching assets to UTXOs · CounterpartyXCP/cips · Discussion #134

CIP: XXX Title: PSBT Support via attaching assets to UTXOs Author: Derp Herpenstein Discussions-To: ?? Status: Draft Type: ?? Created: 2024-1-26 Definitions PSBT - Partially signed bitcoin transact...

-

its not a binary

its not a binary -

Yeah that is why I said “like atomic swap” here

Yeah that is why I said “like atomic swap” here -

you have to ween users off of dispensers and onto the better solution

you have to ween users off of dispensers and onto the better solution -

-

-

one thing to consider is that any offchain solution to dispensers incurs a lot of fees to the operator

one thing to consider is that any offchain solution to dispensers incurs a lot of fees to the operator -

would be a tough sell

would be a tough sell -

-

because the fees have been eaten by the nework as a whole up to now

-

-

because the operator doesnt send individual assets out when they receive payments

because the operator doesnt send individual assets out when they receive payments -

with dispensers

with dispensers -

-

so you could sell 100 editions for one tx fee

so you could sell 100 editions for one tx fee -

or 100 editions for 100 tx fees

or 100 editions for 100 tx fees -

-

-

-

yes, i think its def possible to be creative with the “binding” tx so that you can create 100 outputs and send 1 asset to each of those outputs in a single tx

yes, i think its def possible to be creative with the “binding” tx so that you can create 100 outputs and send 1 asset to each of those outputs in a single tx -

so yes it will be a higher fee than a dispenser creation but its still done in one tx

so yes it will be a higher fee than a dispenser creation but its still done in one tx -

and the selling point is that there’s zero risk of having to send funds back to people that sent btc to a high demand dispenser and didnt get anything

and the selling point is that there’s zero risk of having to send funds back to people that sent btc to a high demand dispenser and didnt get anything -

-

it will be solved in the fact that the loser doesnt lose money

it will be solved in the fact that the loser doesnt lose money -

their tx fails

their tx fails -

-

-

front running still would exist because thats how bitcoin works, but yeah either your tx is confirmed and you get the asset or its not confirmed and you dont

front running still would exist because thats how bitcoin works, but yeah either your tx is confirmed and you get the asset or its not confirmed and you dont -

but no funds lost

but no funds lost -

-

-

-

Ok

Ok -

private mempools help mitigate that

private mempools help mitigate that -

which is what the brc-20 community is finding out

which is what the brc-20 community is finding out -

-

In the atomic swap alternative I mean

In the atomic swap alternative I mean -

actually they probly make it worse lol

actually they probly make it worse lol -

to be clear: the UTXO tracking necessary for Derp's CIP will have a substantial externalized cost, too, so an XCP fee for binding counterparty assets to UTXOs should be contemplated, as well. OTOH since they're trustless you don't need to make dishonest behavior prohibitively expensive.

-

there are no addresses, assets bound to utxos

there are no addresses, assets bound to utxos -

But I’m ok with that. If I could mine a block I would put whatever I want in it 🤓

But I’m ok with that. If I could mine a block I would put whatever I want in it 🤓 -

im against adding xcp here because of the extra friction

im against adding xcp here because of the extra friction -

you can mitigate that with tx chaining

-

you can send to many addresses or bind to utxos

you can send to many addresses or bind to utxos -

i dont see a reason for the 2nd to have an xcp fee

i dont see a reason for the 2nd to have an xcp fee -

My position is that any use-case which has a disproportionate affect on the network should incur fees.

-

you could say that about everything

you could say that about everything -

...

-

sure

-

any feature adds computational cost

any feature adds computational cost -

we live in an age of indexers without native tokens, you want users to chose counterparty not add a layer of friction

we live in an age of indexers without native tokens, you want users to chose counterparty not add a layer of friction -

Well then is totally different from dispensers. I wouldn’t call it a replacement, but a new way

Well then is totally different from dispensers. I wouldn’t call it a replacement, but a new way -

yes it is totally different

yes it is totally different -

but in this case the change being contemplated breaks Counterparty's architecture in a new way, as a direct result of which performance takes a massive hit.

-

not worth the cost of friction

not worth the cost of friction -

I understand your opinion; I have mine

-

-

wasnt too long ago we had a contentious fork because of wanting to add xcp fees 😛

wasnt too long ago we had a contentious fork because of wanting to add xcp fees 😛 -

I've said over and over that my opposition to that fork wasn't because it added xcp fees

-

im just saying in general, not you specifically

im just saying in general, not you specifically -

its a hot button topic

its a hot button topic -

Oh sure.

-

the goal of utxo binding is to eliminate a giant computational cost (dispensers) so on net you still come out on top keeping it free of an xcp fee

the goal of utxo binding is to eliminate a giant computational cost (dispensers) so on net you still come out on top keeping it free of an xcp fee -

You will have to track utxos now right? So is not free either…

You will have to track utxos now right? So is not free either… -

this is all assuming there's a future in which dispensers are free

-

which I disagree with

-

def not free

def not free -

on net if it results in dispensers being sunset then it will be

on net if it results in dispensers being sunset then it will be -

My thinking is pretty straightforward: this is a fee for using a feature which will tangibly degrade the network; that feature does not yet exist and therefore the fee isn't prejudiced against any specific use-case; that fee will be charged to existing users of the platform and therefore will not prevent new users from joining the network. the fee will be denominated in XCP, Counterparty's native currency, which was created in a provably fair and decentralized way. liquidity for the XCP will be provided by the feature itself, with the XCP/BTC trading pair.

-

-

its not hard to imagine the conversations if announce a new version with XCP fees on dispensers

its not hard to imagine the conversations if announce a new version with XCP fees on dispensers -

you dont have to sell me on XCP, ive been living with it for 10 years

you dont have to sell me on XCP, ive been living with it for 10 years -

i understand the pros and cons

i understand the pros and cons -

I'm not selling you on XCP or anything, I am explaining why I think this is a reasonable place for a fee.

-

i get it but i also understand the reality of the landscape we find ourselves in

i get it but i also understand the reality of the landscape we find ourselves in -

its a good conversation to have regardless, would be interesting to get others thoughts

its a good conversation to have regardless, would be interesting to get others thoughts -

this is what was tough about the contentious fork drama: Counterparty _does_ have a free-rider problem; that free-rider problem is partly because Counterparty isn't sticky; Counterparty isn't sticky because it has nonsensical tokenomics.

The above ofc has nothing to do with charging fees for numeric assets -

psbts create a huge opportunity for whoever wants to build that marketplace

psbts create a huge opportunity for whoever wants to build that marketplace -

people hear the word "fees" and think "friction". it's not that simple. fees can (and generally should be) dynamic, so that fees are very low as long as usage is low. and there are ways of making fee payments transparent to the user. but not all features have the same computational/storage cost, and BTC fees aren't enough for supporting heavier transactions

-

the first question someone will ask is “why doesnt ord have this problem?"

the first question someone will ask is “why doesnt ord have this problem?" -

or any of the other indexers built on top of it

or any of the other indexers built on top of it -

you’ll need a VERY compelling argument

you’ll need a VERY compelling argument -

sure.

-

IMO xcp fees make most sense for features that are unique to counterparty

IMO xcp fees make most sense for features that are unique to counterparty -

like issuing named assets and sweeps and dividends

like issuing named assets and sweeps and dividends -

applying them to basic functions that other bitcoin based tokens can do without a native token fee would be just shooting ourselves in the foot

applying them to basic functions that other bitcoin based tokens can do without a native token fee would be just shooting ourselves in the foot -

nothing better than having to beg for forgiveness for adding fees denominated in a fairly minted currency for a feature which has a direct impact on node operators, while everyone cheers on 'governance tokens'

-

this is a self-created problem because we've been crying mea culpa since day 1 for having created XCP in the first place.

-

yes so lets not exacerbate it lol

yes so lets not exacerbate it lol -

that's not how it works

-

You don't change the narrative by conceding a faulty premise

-

it wasnt faulty at the time

it wasnt faulty at the time -

things change

things change -

its not conceding anything

its not conceding anything -

no one is asking to remove XCP fees from named issuances for example

no one is asking to remove XCP fees from named issuances for example -

or sweeps or dividends

or sweeps or dividends -

lol, that's because those fees were added without asking anyone

-

all the more reason to ask for them to be removed

all the more reason to ask for them to be removed -

that is not how human psychology works

-

sir

sir -

🤷♀️ idk what to say. I am fine with disagreeing on this point.

-

hahaha me too

hahaha me too -

better to get more opinions

better to get more opinions -

Imagine having to pay XCP to do a send

Imagine having to pay XCP to do a send -

-

or make an order

or make an order -

better analogy in this case

better analogy in this case -

-

-

by this same logic dispensers are perfect.

-

-

-

the network exists for the users, to be sure, but the whole thing breaks if there isn't a virtuous cycle between the platform and the users.

-

(and to jump to the conclusion: yes, the platform is basically broken as of 9.61.1; and yes, I directly attribute that to Counterparty's broken tokenomics)

-

My opinion would be that fees should only be on functionality that has direct alignment of incentives with users.

I think this is a good example of when a fee directly aligns. https://github.com/CounterpartyXCP/cips/discussions/127Bundled Txs = 80% Lower Fees · CounterpartyXCP/cips · Discussion #127By bundling multiple Counterparty messages from several users into one Bitcoin transaction, I believe it can be possible to reduce fees by >80%. Key assumptions: A bitcoin address can be recover...

-

@herpenstein how about dispensers

-

-

you’re making xchain’s argument

you’re making xchain’s argument -

*that* is broken tokenomics.

-

stamps are a burden we need an xcp fee on numerics

stamps are a burden we need an xcp fee on numerics -

network cant handle it

network cant handle it -

they weren't a burden

-

that was not a real argument

-

and neither are dispensers to the users

and neither are dispensers to the users -

and xchain makes reverse argument

and xchain makes reverse argument -

lol, you surely understand why that is not apples-to-apples, but whatever.

-

“dispensers just fine here"

“dispensers just fine here" -

if removing all barriers to entry were the best way to guarantee success then we'd all be using Open Transactions.

-

everyone is using ord

everyone is using ord -

there are cultural reasons for that

-

and lower friction reasons

and lower friction reasons -

-

-

_pumping XCP_ is no one's goal; coordinating XCP's utility with the network's usage absolutely _is_ a goal.

-

what if it was just a higher btc fee for heavier txs

what if it was just a higher btc fee for heavier txs -

accomplishes the same thing and doesnt pump XCP

accomplishes the same thing and doesnt pump XCP -

Then Counterparty as a platform still atrophies.

-

-

-

-

-

if name registration isn't 'scammy tokenomics' then tying fees to computational load certainly isn't

-

xchain argument

xchain argument -

it just isn't joe

-

i don't know what to tell you

-

numeric issuances don't break Counterparty's entire transaction model

-

-

thats how it looks, most people dont understand nuance here

thats how it looks, most people dont understand nuance here -

you keep flipflopping between how it looks and what it is. If you enjoy debating for its own sake this makes sense but it's not arguing in good faith.

-

no i think ive been consistent, im agreeing the argument is different from xchain argument but im not agreeing xcp is the solution

no i think ive been consistent, im agreeing the argument is different from xchain argument but im not agreeing xcp is the solution -

okay that's fine

-

and im just pointing out from the surface it looks just like numeric asset argument

and im just pointing out from the surface it looks just like numeric asset argument -

so you’re fighting an uphill battle

so you’re fighting an uphill battle -

What do you feel needs to be "paid" for, or a fee charged for, in principle, so I understand ?

What do you feel needs to be "paid" for, or a fee charged for, in principle, so I understand ? -

and it does add friction, anyone thats used counterparty can attest to that, its one of the main reasons stamps uses numerics

and it does add friction, anyone thats used counterparty can attest to that, its one of the main reasons stamps uses numerics -

-

we can add tx chaining so that xcp purchase and utxo binding happen in the same block

-

purchase from where?

purchase from where? -

The main problem with dispensers is in the backend. For users, they are great. That is a problem we need to figure out how to solve…

The main problem with dispensers is in the backend. For users, they are great. That is a problem we need to figure out how to solve…

Thinking that maybe we should just require dispense transactions to include a CNTRPRTY message and that will solve the backend’s performance issues and there will be no need to add a fee to dispensers. -

im def onboard with that

im def onboard with that -

adam mentioned that to me before. but dispenses aren't even counterparty transactions...

-

I think you can do this with an onchain btc/xcp market.

-

people need to send to dispenser from a counterparty aware wallet anyway

people need to send to dispenser from a counterparty aware wallet anyway -

so having a message included to make it valid makes sense

so having a message included to make it valid makes sense -

and that would put them on par with an order

and that would put them on par with an order -

as far as computational cost

as far as computational cost -

As I've said at length, transactions which _by design_ (*not* numeric issuances e..g) have an *outsized* externalized cost should be more costly.

-

It's great that dispensers onboarded so many users, but they almost broke everything.

-

But there is zero link between the platform, and XCP burned

But there is zero link between the platform, and XCP burned -

well we’re talking hypotheticals here anyway, why not wait to have the conversation until after you know what that cost is

well we’re talking hypotheticals here anyway, why not wait to have the conversation until after you know what that cost is -

because it came up...

-

-

that isn't the only math that matters here

-

bitcoin node operators don't get paid to run nodes, but they do. but if btc were worthless, they wouldn't.

-

-

-

Then we should make them. The simplest possible way, maybe even allow clear text CNTRPRTY by itself in the op return would be cool

Then we should make them. The simplest possible way, maybe even allow clear text CNTRPRTY by itself in the op return would be cool -

should add a message id

should add a message id -

make it clean

make it clean -

I am worried about the fact that there was a consensus bug exploited in the wild for 2.5 years and no one caught it. I think the reason for that is that users of Counterparty don't know they're using Counterparty for the most part and astonishingly there seems to be a consensus that that's a good thing.

-

2014-2015 users are a much different breed than 2024 users

2014-2015 users are a much different breed than 2024 users -

-

How does fees figure into that?

How does fees figure into that? -

-

Some specific exploit found?

Some specific exploit found? -

there are more bitcoin nodes today than there were in 2014-2015

-

Periwig Reascends in Counterparty Developers

bitcoin node operators don't get paid to run nodes, but they do. but if btc were worthless, they wouldn't.

-

-

-

the truncation issue. there was also a _divide by fucking zero_ error which was caught by the generic exception handling.

-

-

-

-

-

XCP's value is untethered to the network usage and there is a strong desire to keep it that way. My argument is that that's what nearly killed Counterparty.

-

-

-

I am not trying to be rude but I'm at a loss for a new way to state my view.

-

- 01 Feb 2024 (128)

- 02 Feb 2024 (26)

- 03 Feb 2024 (40)

- 05 Feb 2024 (12)

- 06 Feb 2024 (17)

- 08 Feb 2024 (9)

- 09 Feb 2024 (12)

- 10 Feb 2024 (40)

- 11 Feb 2024 (97)

- 12 Feb 2024 (195)

- 13 Feb 2024 (9)

- 18 Feb 2024 (6)

- 19 Feb 2024 (38)

- 20 Feb 2024 (15)

- 21 Feb 2024 (117)

- 22 Feb 2024 (60)

- 23 Feb 2024 (34)

- 24 Feb 2024 (74)

- 25 Feb 2024 (122)

- 26 Feb 2024 (783)

- 27 Feb 2024 (447)

- 28 Feb 2024 (108)

- 29 Feb 2024 (64)